Table of Contents

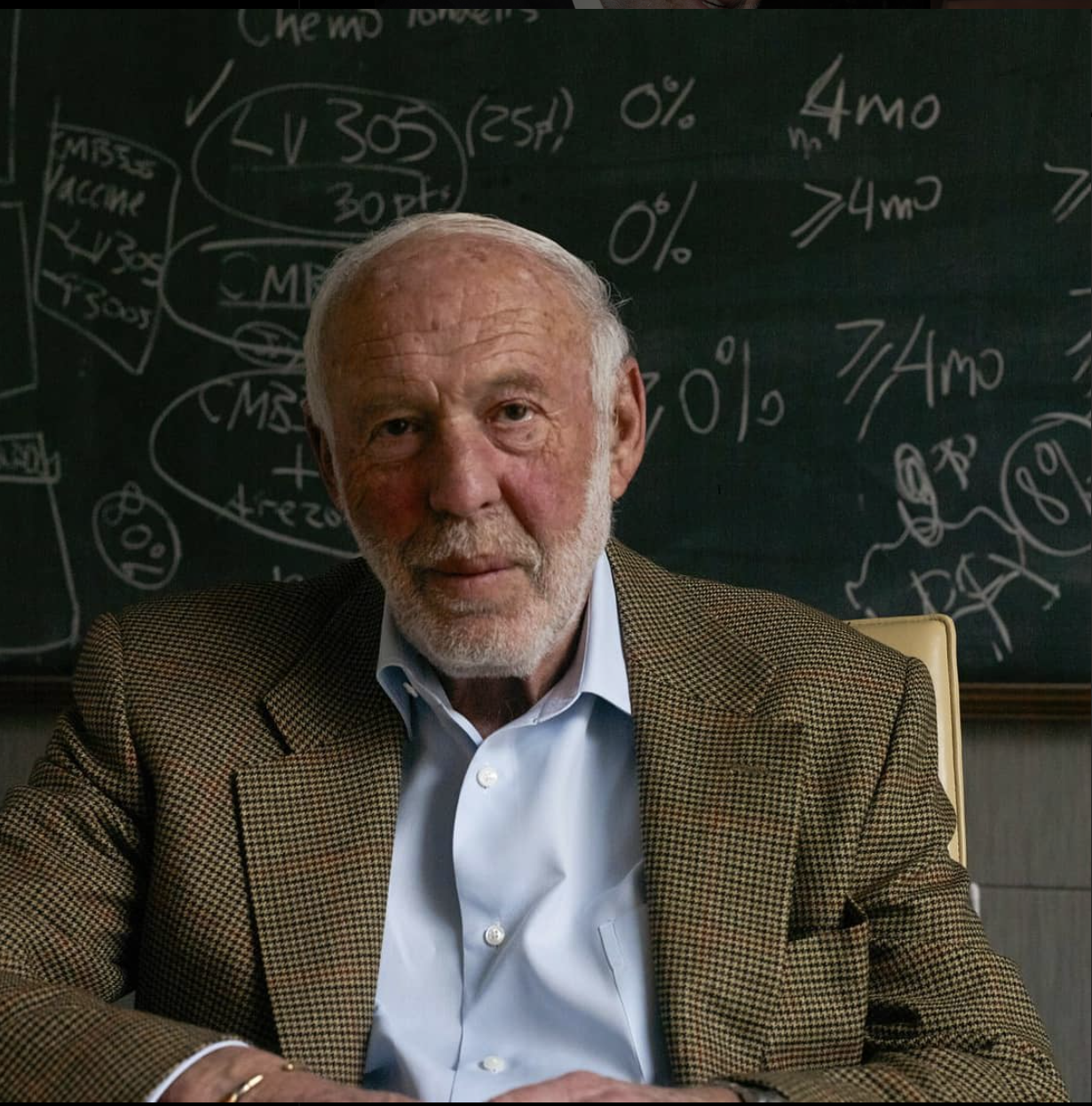

Jim Simons

Who is Jim Simons?

- Renowned mathematician, hedge fund manager, and philanthropist.

- Founder of Renaissance Technologies, a highly successful quantitative hedge fund firm.

- Known for his groundbreaking work in differential geometry and topology before transitioning to finance.

- Widely regarded as one of the most successful investors in history, with his hedge fund consistently delivering exceptional returns.

- Prefers to stay out of the public eye, focusing instead on his work, research, and philanthropy.

- He founded the Simons Foundation, which supports research in mathematics, life sciences, and autism.

What is Jim Simons’s background?

- Born in Newton, Massachusetts, USA.

- Holds a Bachelor’s degree in mathematics from the Massachusetts Institute of Technology (MIT).

- Earned a PhD in mathematics from the University of California, Berkeley.

- Prior to his career in finance, he was a distinguished mathematician, making significant contributions to differential geometry and topology.

What led Jim Simons into the stock market ?

- Quest for a New Challenge: After conquering the realm of mathematics, Simons sought a new intellectual frontier, finding the complexity and dynamism of the stock market irresistibly alluring.

- Mathematical Curiosity Unleashed: Simons, driven by his insatiable curiosity and belief in the power of mathematics, was intrigued by the prospect of applying rigorous quantitative methods to decode the mysteries of financial markets, propelling him into the world of stock trading.

What is Jim Simons’s net worth?

- Jim Simons’s estimated net worth exceeds $23 billion as of 2022, placing him among the wealthiest individuals globally.

- RenTec, short for Renaissance Technologies, stands as a cornerstone of Jim Simons’s financial empire, renowned for its pioneering work in quantitative trading strategies.

- Founded by Simons in 1982, RenTec has become one of the most successful hedge fund firms in the world, leveraging advanced mathematical models and algorithms to generate exceptional returns.

How much returns Jim Simons generated from stock market ?

- Achieved an impressive compounded annual growth rate (CAGR) of around 66% from 1988 to 2018.

- Jim Simons has outperformed Warren Buffett in terms of returns, especially with his quantitative trading strategies.

- Notable partners include Leonard Baum, James Ax, and Elwyn Berlekamp, who contributed significantly to developing mathematical models for trading.

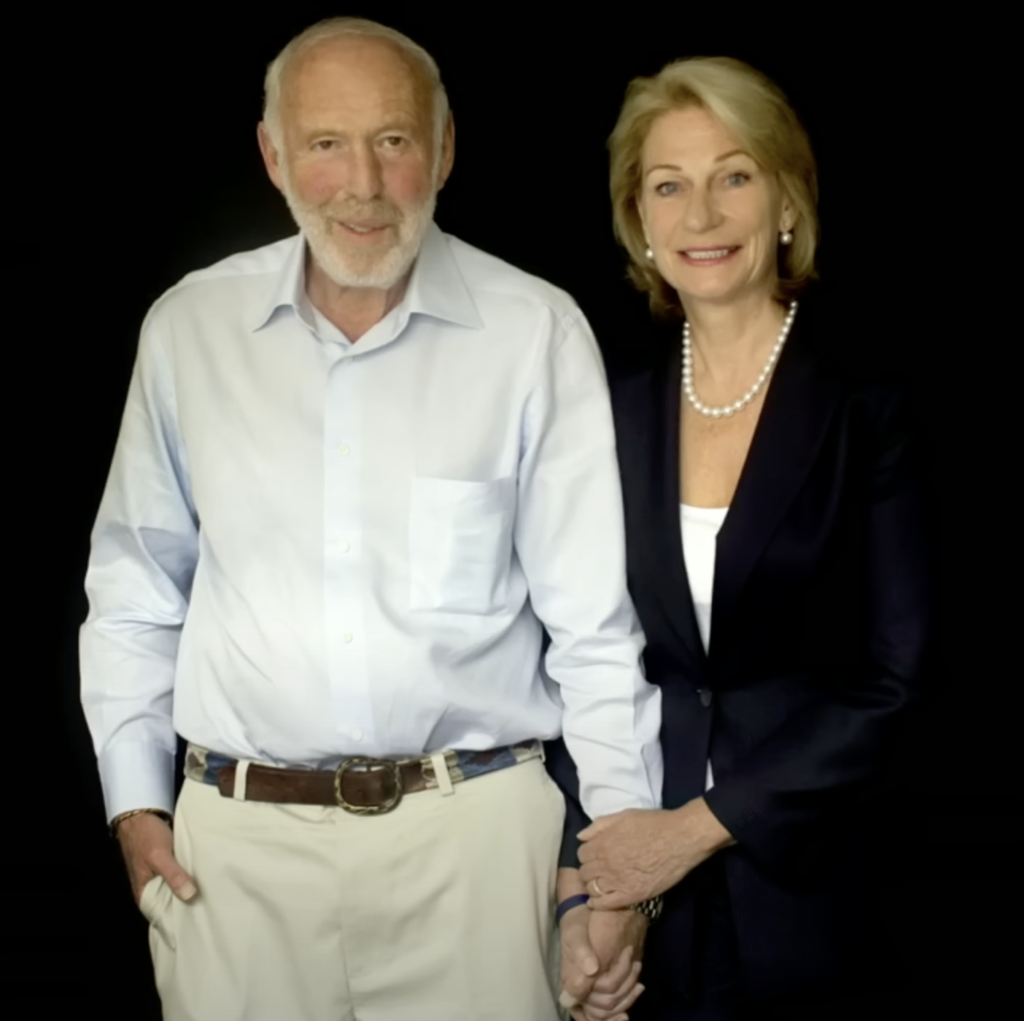

Jim Simons Interview on Youtube

You might be interested in below article

Visit https://dumbmoneyjournal.com/ for more such contents.